Information is the New Supply

Throughout history, advancements made by civilizations have all occurred due to increases in information velocity, the rate at which new information is transmitted, and used. All major technology advancements made by ancient and current civilizations which have caused information velocity to increase-causing stronger economic activity. The spoken and written language, Roman Road System, sailing, Gutenberg Printing Press, Panama Canal, US Railroad System, public transportation, morse code, ATMs, internet, smartphones, and last but the not least, social media have all boosted economic activity; and consequently, leading to higher price (or market) volatility.

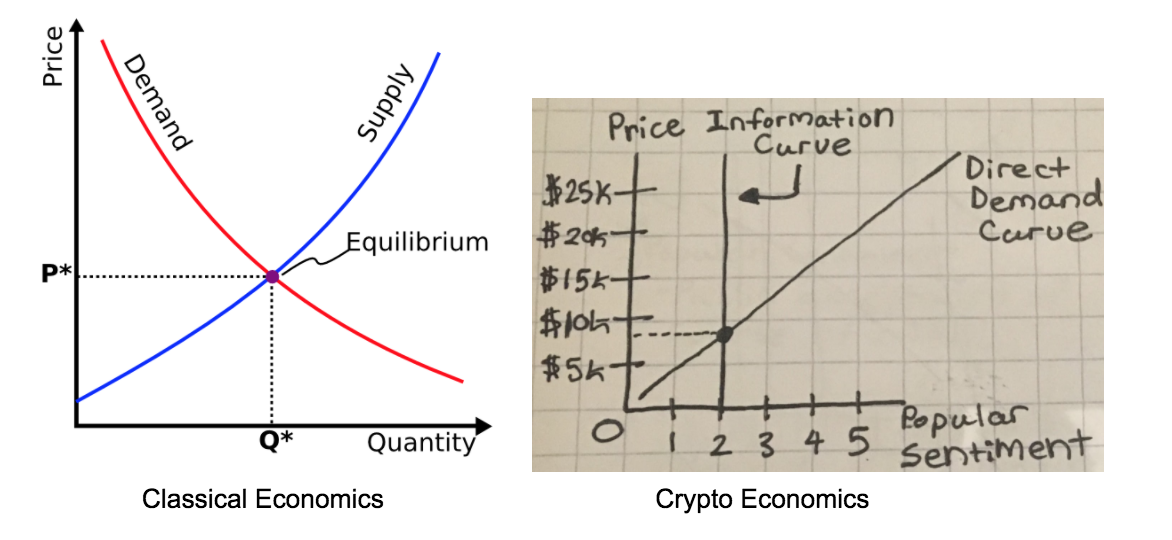

In Classical Economics, everything goes back to; Supply and Demand. In this post, I will show you why the Classical Means of Production; specifically the Supply curve is nonexistent in Crypto Economics and how it has morphed into the “Information” curve.

The image on the left was taken from: http://www.titaniumteddybear.net/wp-content/uploads/2011/07/supply-demand-curve.png

Core Crypto-Economic Assumptions:

Crypto Economics is the study of how crypto-assets are used to allocate scarce resources (commodities, human labor, computing power, energy & etc.)

Popular sentiment is the general public’s perception of cryptocurrencies’ market viability

A direct demand economy is a market where buyers and sellers can transact without middlemen

The crypto-currency market is a demand-driven P2P economy

Crypto traders have low barriers to trading crypto-assets without any middlemen

Supply-driven price manipulation has little to no impact on long-term crypto assets’ values because supply constraints are non-existent

Crypto assets’ values and market popularity will always move in unison and are co-dependent of each other

Information is ubiquitous

Information messengers are not equal in their impact on crypto asset values and popular sentiment

The cryptocurrency market has the highest information velocity than all other financial markets due to limited government regulation

The low barriers to entry in cryptocurrency markets speed up information velocity

I am assuming ceteris paribus with other crypto economic variables outside of information, popular sentiment and crypto asset prices

Over time, fiat currency inflation (or supply increases) will drive up crypto asset prices

Crypto asset exchanges are information inhibitors due to the physical location of traders using their exchange, local fiat inflation, and governmental regulations. This causes them to have different prices for the same cryptocurrencies.

The Blockchain and DAGs were created to eliminate all forms of middlemen (government, central and commercial banks). Both are used to create direct P2P channels for people to share information and commerce, directly. With cryptocurrencies, there is limitless supply, meaning new and existing coins can be electronically mined or fractionalized (infinitely), at any time, without any extra costs, unlike fiat currency or physical assets, which must be manually mined out of a cave, drilled from earth's core, or manufactured in a factory. Blockchain and DAGs have transaction processing constraints-Ethereum can process 13 transactions per second whereas Facebook handles 175,000 requests per second (In test environments, DAGs are projected to have higher transaction power over Blockchains). As a result, the Classical Supply curve principle does not hold because we are dealing with direct demand with limitless supply. Crypto-currency traders are not trading money; they are trading information. Crypto assets’ price volatility is due to having high-speed information velocity. If other financial markets such as stocks, bonds, and real estate had the same information velocity; they would have similar market volatility. Telegram, Twitter, Medium, VK, Discord, and Facebook are the main drivers of crypto asset information velocity.

News organizations such as Bloomberg, Reuters, CNBC (MSNBC), CNN or BBC have bigger information velocity influence on crypto asset values and popular sentiment than crypto-specific news organizations such as CoinDesk or CoinTelegraph because Bloomberg, Reuters, CNBC (MSNBC), CNN and BBC have wider consumer bases while CoinDesk and CoinTelegraph are niche-specific Blockchain news organizations with smaller audiences.

During a bull market, almost all investment media news and information will be positive (or negative news gets drowned out) because most market participants “perceive” themselves to be turning a profit; due to consistent asset value growth. The positive news is a precedent and protagonist of bull markets.

What is the Information Curve?

It is a graphical representation of how public information influences crypto assets’ values, popular sentiment and price volatility. It is a vertical line that moves right or left across the direct demand curve depicting the impact of new information impacting the crypto assets market. The point of intersection where direct demand and the information curves meet represent crypto assets’ value equilibrium and popular sentiment. Higher crypto values equal higher cryptocurrency market confidence (or over-exuberance).

I chose to focus my analysis on Bitcoin (BTC) because crypto exchanges use BTC in all of their crypto trading parities. I used Google Trends, to show how BTC's popular sentiment changes and correlate those changes to major BTC (or crypto) events. BTC’s price movements validate my core assumptions around crypto-economics. In Google Trends, a score of 100, means peak popularity, 50 means popularity is half of any all-time peaks and 0 means there wasn’t enough information (As mentioned, on Google Trends). I chose to focus on BTC because crypto exchanges use BTC in all crypto asset trading parities. I used CoinMarketCap to verify BTC’s price data. Google Trends data updates continuously, so your data analysis of BTC's sentiment may be different from minds.

News Event #1: Mt.Gox announced they were hacked

Before Mt.Gox Announcement:

BTC’s Popular Sentiment: 3

After Mt. Gox’s Announcement:

BTC’s Popular Sentiment: 1

In June 2011, after announcing the hack, in the process of minutes, the BTC price plummeted to pennies on the dollar from a $17 high. BTC’s popular sentiment fell by 66% in less than a month; from 3 to 1.

News Event #2: CNBC sends out this tweet on Saturday, December 16th, 2017

Before CNBC’s tweet:

BTC’s Popular Sentiment: 50

After CNBC’s Tweet:

BTC’s Popular Sentiment: 100

BTC hit an all-time high of $20K and even $23K in individual countries like South Korea.

News Event #3: On January 2nd, 2017, China sent out memos to shut down Bitcoin Miners, and on January 10th, 2017, South Korea’s Finance Minister hints at banning crypto-trading

After South Korea and China’s actions:

BTC’s Popular Sentiment: 57

BTC’s popular sentiment fell by 43%. As you can see, since January 8th,2018, BTC’s price has been trending downward.

Information provided by CoinmarketCap.com

BTC’s price fell by $7,305.90 or 41.68% in less than a month.

News Event #5: On Friday, February 2nd, 2017 JP Morgan, Chase, and Bank of America banned crypto purchases from credit cards.

After Announcements:

BTC’s Popular Sentiment: 35

BTC’s price dropped again and closed at $6,955.27 on Monday, February 5th. This was a $1,875.48 decrease (21.2% drop) from Friday, February 2nd’s closing price.

News Event #6: On February 7th, at the US Senate hearing, the US CFTC made favorable remarks were made about BTC. More favorable governmental support occurred in Germany, Singapore, and the European Central Bank.

Before Announcement:

BTC’s Popular Sentiment: 40

After Announcement:

BTC’s Popular Sentiment: 59

On Thursday, February 8th, BTC’s popular sentiment increased to 59 which was a 19 point (or 47.5%) increase from late January's popular sentiment rating. BTC’s close price on Thursday, February 8th, increased by $644.29 (8.45%) from $7,621.30 from it’s Wednesday, February 9th close price.

Crypto-Economics Summations:

Information messengers (news organizations and individuals) with bigger audiences have a stronger influence on BTC’s popularity and price

Crypto information flow velocity and consumption is faster than any other global financial market

Crypto trading has low barriers to entry which amplifies the financial impact of new news

The traditional Supply curve does not hold in crypto-economics because direct demand drives production and fractionalization of new and existing coins

To predict long-term crypto asset price changes, watch BTC’s popularity trends

Major national holidays, such as Thanksgiving or Christmas that culminate in family gatherings serve as “information hubs” which add exponential growth to information feedback loops

In bull markets, almost all investment media news and information will be positive (or negative news gets drowned out).

New ICO projects, government and financial market luminaries must do a better job of making blockchain technology better real-world applications to keep BTC’s popularity and price stable; they must amplify true and accurate information

BTC’s price will not hit $100K per coin (or $20K again) until it’s popularity sentiment increases back to December 2018 levels

BTC’s popular sentiment is a leading indicator of major (short or long term) price changes

A majority of crypto traders have not read BTC’s (or any altcoins') whitepaper

ICO project teams need to do a better job of building communities and community engagement to allow their coins to become more independent of BTC price fluctuations

I would like to thank Bushra, Mark, Kingsley (for the blog title) and Blackchain for proofreading this post. If you have any recommendations on my analysis, feel free to share. I am not a financial advisor, and this is not investment advice.

Donate to help fund further crypto-economic analysis:

BTC: 1LpyW83yTW4jQuDvVLW9H2vWf8SyGu8EqU

ETH: 0x0a164f29A2d08158Cc04Acb35e17Cbe9bFFFA13A

NEO: AcvZKu3gwXkuKU7aeXetBaEUGnTzsJKRv9